by Kenny | Jun 29, 2025 | Uncategorized

The S&P 500 and the NASDAQ joined the NASDAQ 100 in forging new all-time highs in an extremely busy week for Wall Street. A de-escalation of the Iran-Israel-US conflict happened on the twelfth day after Israel’s initial strikes. The US bombed three key... by Kenny | Jun 25, 2025 | Uncategorized

By Ian Berger, JD IRA Analyst If you’re in a 457(b) plan and are nearing retirement, you may want to consider an often-overlooked rule that could allow you to defer twice the usual annual elective deferral limit (for 2025, $23,000 x 2 = $47,000) in the three... by Kenny | Jun 23, 2025 | Uncategorized

By Sarah Brenner, JD Director of Retirement Education The year 2025 has been a turbulent time for the economy. Whether due to job loss or persons seeking better investment opportunities in volatile markets, retirement account funds are on the move more than...

by Kenny | Jun 22, 2025 | Uncategorized

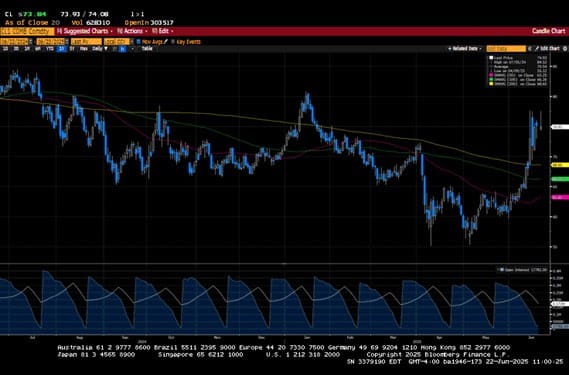

Despite there being plenty for investors to consider, the holiday-shortened week ended pretty much where it started. Israel and Iran continued to exchange missile attacks, while global leaders tried to find a resolution to the conflict. President Trump opened the door... by Kenny | Jun 19, 2025 | Uncategorized

By Sarah Brenner, JD Director of Retirement Education Question: I am age 85, and my wife is age 75. If I die first and my wife inherits my IRA, are the required minimum distributions (RMDs) that my wife must take after my death calculated using her age or my age?... by Kenny | Jun 18, 2025 | Uncategorized

By Andy Ives, CFP®, AIF® IRA Analyst Before he transformed into the Incredible Hulk, Bruce Banner once said to his antagonist, “Don’t make me angry. You wouldn’t like me when I’m angry.” That’s a little how I feel when I hear stories about lazy financial professionals...