by Kenny | Jun 8, 2025 | Uncategorized

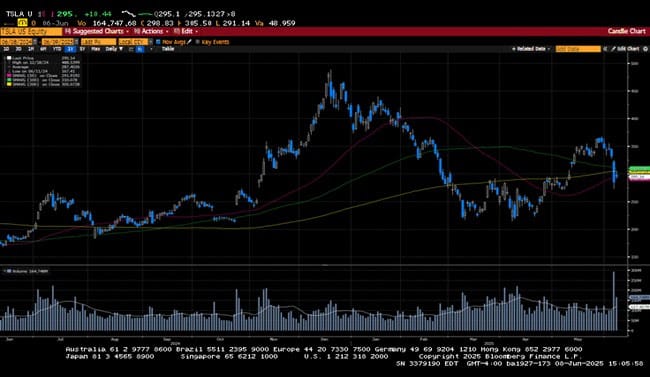

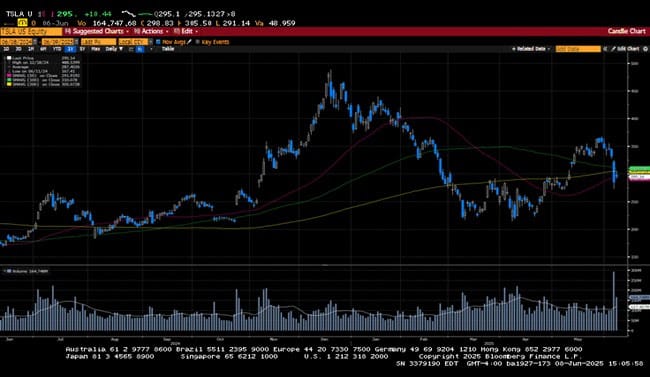

US markets advanced in an erratic week of trading. The S&P 500 ended the week above the 6000 level and is up nearly 24% from the April 7th lows. Investors continue monitoring global trade policy, hoping more trade deals will be signed soon. Trump acknowledged... by Kenny | Jun 5, 2025 | Uncategorized

By Ian Berger, JD IRA Analyst Question: Recently, I’ve received dozens of emails suggesting that traditional IRA owners can convert to a Roth IRA and somehow avoid all or some tax. Is this a scam? Thank you in advance. Bill Answer: Hi Bill, There is no way for...

by Kenny | Jun 2, 2025 | Uncategorized

-Darren Leavitt, CFA The holiday-shortened week was busy. Trade uncertainties continued to be on investors’ minds, with several trade stories hitting the tape throughout the week. News on Tuesday that President Trump had extended the timeline for negotiations... by Kenny | May 29, 2025 | Uncategorized

By Sarah Brenner, JD Director of Retirement Education Question: Hello, I have a question concerning inherited Roth IRAs. I know that in the past you have said that no annual required minimum distributions (RMDs) are required for these accounts. Does this... by Kenny | May 28, 2025 | Uncategorized

By Andy Ives, CFP®, AIF® IRA Analyst Regardless of the topic, we could all use an occasional refresher. Retirement account rules are incredibly complicated, and we all have our blind spots. Even seasoned financial advisors with extensive client lists can overlook... by Kenny | May 22, 2025 | Uncategorized

By Andy Ives, CFP®, AIF® IRA Analyst QUESTION: Thank you for all you do to educate the public. I’m hoping you guys can settle a debate that’s been going on with a few financial advisors and CPAs regarding the 5-year rule for Roth IRA conversions. I was...