Weekly Market Commentary – 2/3/2023

-Darren Leavitt, CFA

Investors were hit with a full dose of market-moving events and data throughout the week. The Federal Reserve, Bank of England, and European Central Bank increased their respective policy rates. The Fed raised its policy rate by 25 basis points to a range of 4.50% to 4.75%. The move was widely expected, but the tone of Federal Reserve Chairman J. Powell’s remarks in Q&A prompted investors to buy the market. The Chairman acknowledged that goods inflation has moderated and used the term disinflation throughout the Q&A. Powell also shrugged off the market’s recent advance and its impact on loosening financial conditions and kept the possibility of a soft landing on the table. US Treasuries rallied significantly on the Chair’s commentary but gave the gains up the following day on an extremely strong Employment Situation Report.

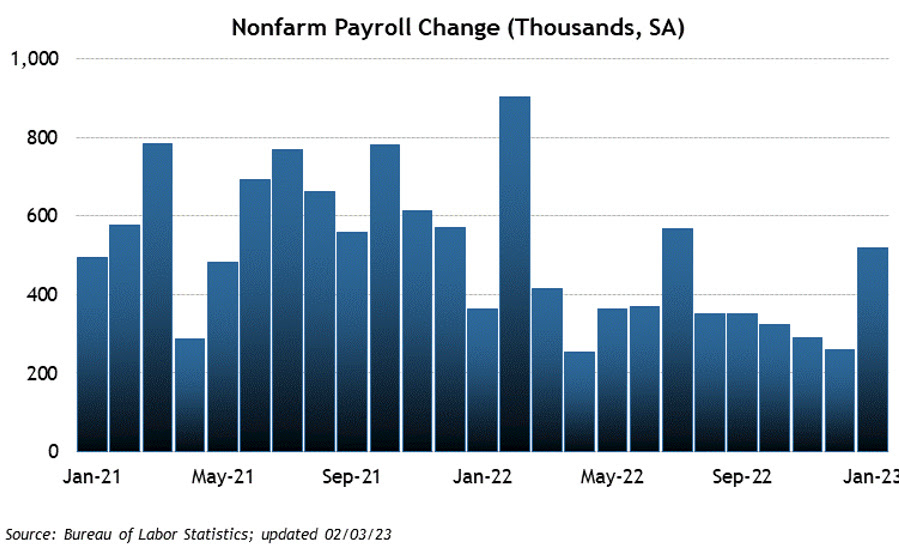

There was a ton of economic data that hit the tape this week. The Employment Situation Report showed Non-Farm Payrolls increased by 517k- the consensus estimate was for a gain of 190k payrolls. The 3-month average of Non-Farm Payrolls increased to 356K from 291k in December. Similarly, Private Payrolls increased by 443K versus an estimated 175k. The Unemployment rate decreased to 3.4%, the lowest level since 1969 and below the expected uptick of 3.6%. Average Hourly earnings were in line with expectations of 0.3%; on a year-over-year basis, wage growth ticked down to 4.4% from 4.8% in December. JOLTS data showed more than 11 million job openings in January, up from 10.45 million in the prior reading. Initial Claims came in less than expected at 183k, and Continuing Claims ticked down to 1655k from 1666K. So despite all the layoff headlines we have seen recently, the labor market looks robust and could present a problem for the Fed in taming inflation. That said, much of this data is backward-looking, which leaves the door open for a moderating labor market in the next few months of data. ISM Manufacturing continued to show contraction with a reading of 47.4%, while ISM Services data showed an expansionary reading with a better-than-expected print of 55.2%.

Fourth quarter earnings continued to roll in with some significant results. Meta surprised the street by beating expectations, announcing more cost-cutting measures, and increasing its share repurchase program to $40 billion. The stock’s price soared 23% on the week. On the other hand, Apple, Merck, Honeywell, Google, Amazon, Starbucks, and Ford delivered disappointing results.

The S&P 500 gained 1.6%, the Dow sank 0.2%, the NASDAQ advanced 3.3%, and the Russell 2000 increased by 3.9%. This week, the US Treasury market had a wild ride with massive moves catalyzed by the FOMC meeting Q&A and the Employment Situation Report. The 2-year note yield increased by eight basis points to 4.29%, while the 10-year bond yield increased by one basis point to 3.53%. Commodity prices took a hit this week. WTI Oil prices fell 7.7% to $73.28 a barrel. Gold prices fell by $52.90 or 2.8% to close at 1876.70 an Oz. Copper prices lost 0.17 or 4% to close at 4.05 a Lb.

Investment advisory services offered through Foundations Investment Advisors, LLC (“FIA”), an SEC registered investment adviser. FIA’s Darren Leavitt authors this commentary which may include information and statistical data obtained from and/or prepared by third party sources that FIA deems reliable but in no way does FIA guarantee the accuracy or completeness. All such third party information and statistical data contained herein is subject to change without notice. Nothing herein constitutes legal, tax or investment advice or any recommendation that any security, portfolio of securities, or investment strategy is suitable for any specific person. Personal investment advice can only be rendered after the engagement of FIA for services, execution of required documentation, including receipt of required disclosures. All investments involve risk and past performance is no guarantee of future results. For registration information on FIA, please go to https://adviserinfo.sec.gov/ and search by our firm name or by our CRD #175083. Advisory services are only offered to clients or prospective clients where FIA and its representatives are properly licensed or exempted.