Weekly Market Commentary – 2/24/2023

-Darren Leavitt, CFA

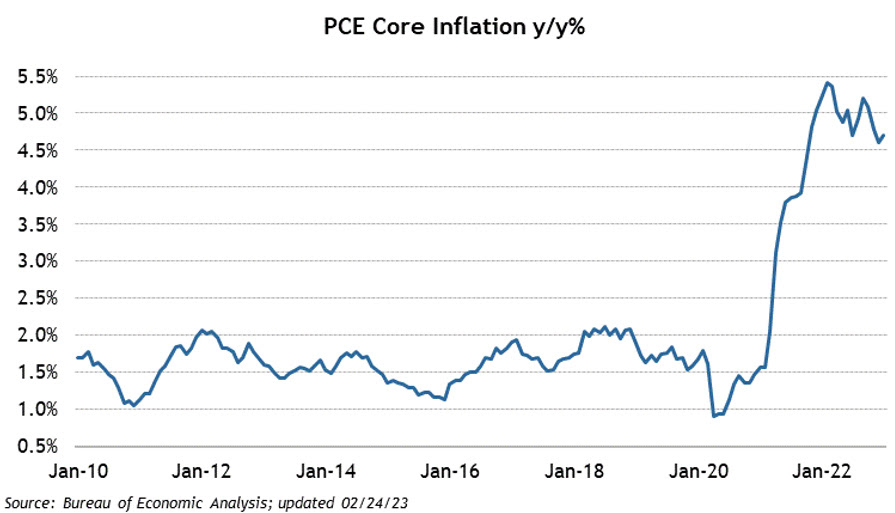

It was another tough week on Wall Street as US equity markets continued to retreat alongside a sustained selloff in the US debt markets. The calendar was again stacked with economic data showing an economy growing nicely with a resilient labor market but with stubbornly higher prices. The minutes from this month’s Federal Open Market Committee meeting offered nothing new but did reinforce the notion that the Federal Reserve still has a long way to go to get inflation to its target rate of 2%. Market pundits pushed back on the idea of a no-landing scenario where the economy could continue to grow alongside elevated inflation with a standoffish Fed. However, St Louis Fed President James Bullard supported the idea of a soft landing where prices moderate and the economy avoids a recession.

Weak earnings from Consumer Staples/Discretionary stalwarts Walmart and Home Depot also troubled investors. Chip maker NVidia had a great quarter and continued to ride the recent AI wave.

The S&P 500 lost 2.7%, breaking its 50-day moving average (3980) but found intraday support at its 200-day moving average (3940). Investors will watch that 200-day moving average for clues on the market’s next move. The Dow shed 3% and is now negative 1% for the year. The NASDAQ gave back 3.3%, and the Russell 2000 fell 2.9%.

The US Treasury market continued to sell off across the curve. Bond prices fall as their yields rise. The 2-year yield increased by seventeen basis points to 4.78%, while the 10-Year bond yield increased by twelve to 3.95%. The higher yields prompted a strong rally in the US dollar, with the DXY index rising by 1.4% on the week. Conversely, commodity prices fell. WTI fell 0.1% on the week closing at $76.41 a barrel. Gold prices fell by $36.90 to $1817 an Oz. Copper prices fell by $0.15 to $3.96 an Lb.

The 2nd estimate of fourth-quarter GDP came in at a resilient 2.74% growth rate but was accompanied by a higher-than-anticipated GDP Price Deflator of 3.7%. Core PCE, the Federal Reserve’s preferred measure of inflation, also came in hotter than expected at 4.7% on a year-over-year basis. Preliminary February IHS Markit Manufacturing and Services PMIs were better than expected at 47.8 and 50.5, respectively. Existing home sales came in at 4 million versus an estimated 4.12 million, while weekly Mortgage Applications fell by 13.3%. Initial Jobless claims came in at 192k, while Continuing Claims fell by 37k to 1.654M.

Investment advisory services offered through Foundations Investment Advisors, LLC (“FIA”), an SEC registered investment adviser. FIA’s Darren Leavitt authors this commentary which may include information and statistical data obtained from and/or prepared by third party sources that FIA deems reliable but in no way does FIA guarantee the accuracy or completeness. All such third party information and statistical data contained herein is subject to change without notice. Nothing herein constitutes legal, tax or investment advice or any recommendation that any security, portfolio of securities, or investment strategy is suitable for any specific person. Personal investment advice can only be rendered after the engagement of FIA for services, execution of required documentation, including receipt of required disclosures. All investments involve risk and past performance is no guarantee of future results. For registration information on FIA, please go to https://adviserinfo.sec.gov/ and search by our firm name or by our CRD #175083. Advisory services are only offered to clients or prospective clients where FIA and its representatives are properly licensed or exempted.